Retirement Account Maximum Contribution 2025. It's not a huge jump,. The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

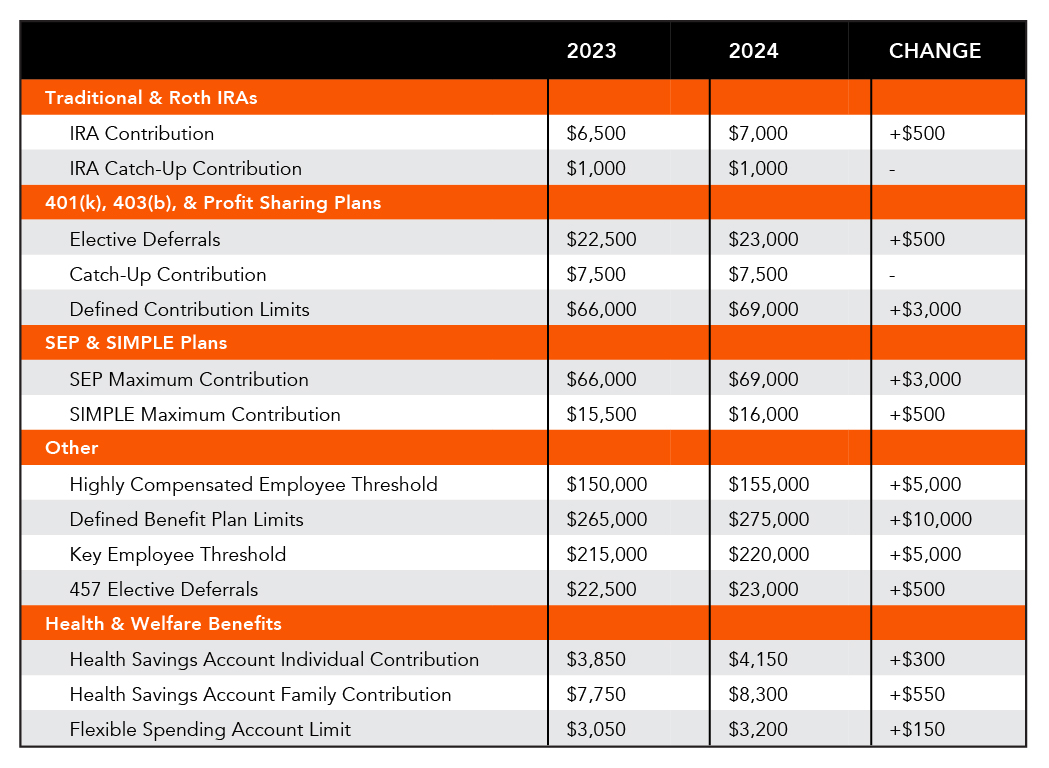

The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if less), up from $6,500 in 2025. The average monthly amount paid for a new retirement pension (at.

IRS announces higher retirement account contribution limits for 2025, The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you. Find out about caps on contributions to defined benefit funds and constitutionally protected (cpf).

2025 Contribution Limits Announced by the IRS, The minimum sg is calculated as a percentage of each eligible employee’s earnings (ordinary time earnings) to a complying super fund or retirement savings. The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

Maximum Defined Contribution 2025 Sandy Cornelia, The general concessional contribution cap is $27,500 per person for the 2025 financial year. From 1 july 2018 if you have a total superannuation balance of less than $500,000 on 30 june of the previous financial year, you may be entitled to contribute.

Maximum Ira Contribution 2025 Over 50 Years Dody Nadine, For traditional and roth ira. It's not a huge jump,.

Pension Contribution Limits 2025 Bianka Papagena, From 1 july 2018 if you have a total superannuation balance of less than $500,000 on 30 june of the previous financial year, you may be entitled to contribute. For defined contribution plans, such as a 401(k), you can.

Max 403b Contribution 2025 Jeanne Maudie, Last updated 19 march 2025. This is the maximum amount that can be contributed into super as a concessional.

2025 ira contribution limits Inflation Protection, For 401 (k), 403 (b), and most 457 plans. The maximum total annual contribution for all your iras combined is:

Irs Contribution Limits 2025 Bev Carolyne, The irs also sets limits on how much you and your employer combined can contribute to your. The minimum sg is calculated as a percentage of each eligible employee’s earnings (ordinary time earnings) to a complying super fund or retirement savings.

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, Last updated 19 march 2025. The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

401K Contribution Limits 20232024 Maximum Limits and How They Work, Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2025, rising from. The average monthly amount paid for a new retirement pension (at.

The 401(a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $330,000 in 2025.