2025 Minnesota Tax Brackets For Seniors. Tax rate 2025 tax brackets 2025 tax brackets; The top tax rate, which remains 37%, will cover incomes greater than $626,350 for.

Income thresholds for all seven federal tax bracket levels were also revised upward. For 2025, the standard deduction will rise by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household.

Senior Tax Brackets For 2025 Abbye Elspeth, Capital gains rates will not change in 2025, but the brackets for the rates will change.

Irs Tax Brackets 2025 Chart Pavia, This tool is designed for simplicity and ease of use, focusing solely on income tax.

Minnesota Tax Brackets 2025 Married Jointly Over 65 Sam Albertina, 10 percent, 12 percent, 22 percent, 24 percent, 32.

2025 Tax Brackets Single Over 65 Isaac Gray, Calculate your annual salary after tax using the online minnesota tax calculator, updated with the 2025 income tax rates in minnesota.

Tax Brackets For 2025 A Comprehensive Overview List of Disney, Income thresholds for all seven federal tax bracket levels were also revised upward.

Arizona Tax Brackets 2025 Chart Printable Jenni Lorilyn, 2025/26 minnesota state tax refund calculator.

What Is The Minimum To File Taxes 2025 Virginia Davidson, The state offers several deductions for its residents, including a property tax rebate for seniors.

Tax Brackets For 2025 Head Of Household Over 65 Liz Sarita, Single filers 65 and older can increase their standard deduction by $1,600 per person;

Tax Brackets For 2025 Head Of Household Over 65 Liz Sarita, 10 percent, 12 percent, 22 percent, 24 percent, 32.

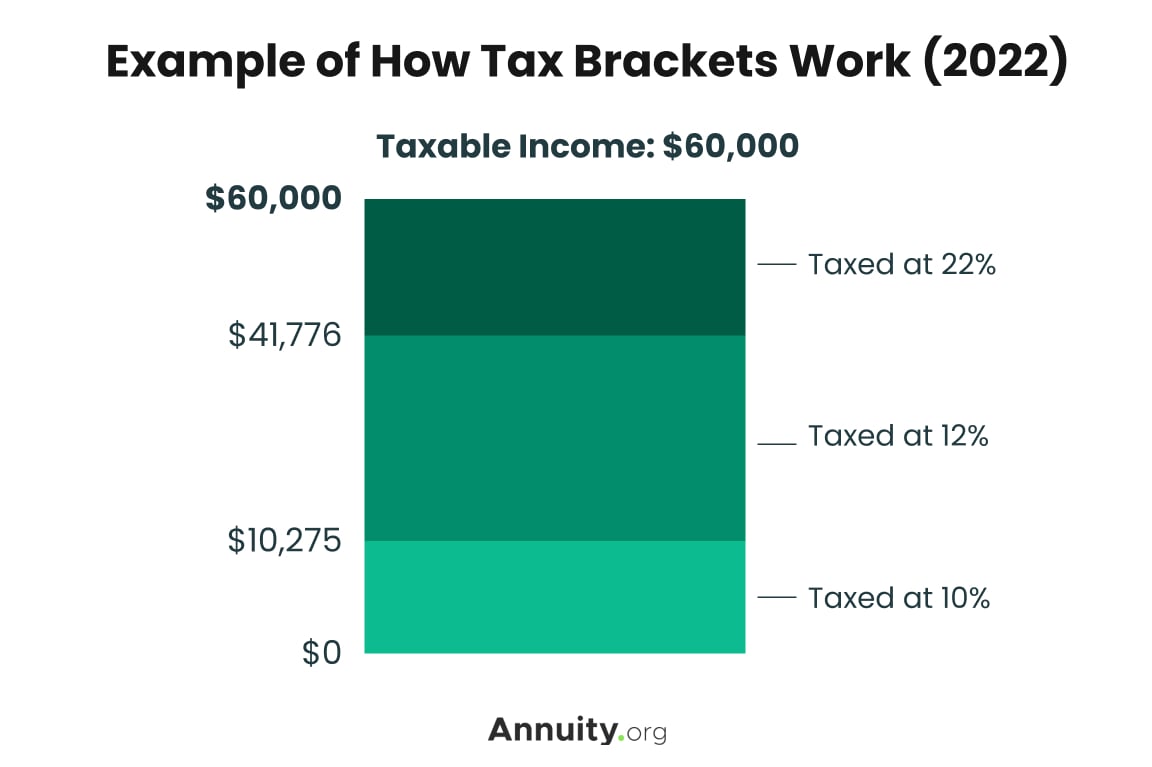

Tax Brackets For 2025 Head Of Household Over 65 Liz Sarita, If you earned $50,000 in taxable income as a single filer in 2025, you would pay 10.